Face Off in Houston

CCUCA Trade Show

Upcoming Seminars

Community of the Month

Anniversaries

Employee Spotlight

Visit Our Website

Community Investments

The U.S. and world economies have been going through some difficult times. Financial gurus point to December 2007 as the start of the current recession and only the brave predict a specific end point. But it will end - they always do. On a more personal basis, we all see the impact in our jobs and savings. Unless we were very conservative, our nest eggs from three years ago shrunk by 30% and have started to rebound. But what about our community associations?

Community associations have three goals in handling money. The first and most important goal is to use the funds for the purposes they were collected - that is, for providing services and amenities for it's residents. Therefore, it's top priority is to preserve principal and not invest in anything that can lose value. The second priority is to make sure funds are available as needed to pay the bills. In other words, an association must be careful to keep funds liquid and not fully tied up in investments which cannot be liquidated without penalty. And finally, the last priority for an association is to earn interest on money on hand. Any interest earned from banks or outside institutions slightly reduces the amount an association must raise from its owners through assessments.

With these investment priorities, it is no surprise that associations should be extremely conservative investors. At C.I.A. Services, we almost exclusively recommend bank accounts, money market accounts and certificates of deposit. None earn big returns but all protect the principal, are insured and are adequately liquid. Although our personal nest eggs may have sagged over the last two years, no association account at C.I.A. Services has lost any principal. Sure investment interest is down but earning interest is our last priority.

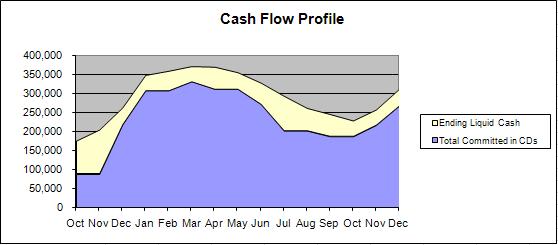

Each year, we prepare a cash flow analysis to allow us to make investment recommendations for our communities. We predict the pattern of revenues, expenses based on historical performance, factor in any scheduled projects and come up with the total cash we should have at any point in the year. We then recommend the purchase of certificates of deposit with terms and denominations such that they are maturing when we need the funds. The board approves the investment approach and we implement it throughout the year.

These are very unusual times, however. In our 25 years in business, we could depend on interest rates increasing like this. Bank checking accounts had the lowest rates; bank money market accounts a little higher; brokerage house money fund accounts a little higher; bank CDs a little higher; and brokerage house CDs the highest. Once in a while we'd see an inverse return with short term CDs earning more than long term CDs but that is not unusual when interest rates are at a peak. Today, everything is jumbled. Brokerage houses are temporarily a non-factor with money funds earning 0.1% and one year CDs at 0.4%. Community Association Banc, which focuses on community association and is less affected by the economy, is paying 0.5% to 1% on their money market account and triple the brokerage house rates on CDs. So, we are now in a situation where we earn more keeping funds in a CAB money market account than purchasing any CD under 7 months.

And finally, the objective always had been to make sure the total amount in any bank stayed under the $100,000 FDIC limit. That FDIC limit has was temporarily increased in 2008 to $250,000 (per tax ID per institution) and has been extended to remain at that level until December 31, 2013. In addition, Community Association Banc is providing Excess Deposits Protection on balances over $250,000. So the need to keep bank accounts under $100,000 for insurance purposes has been eliminated for the next few years.

Please ask your Community Manager if you have any questions about current investments.

Face Off in Houston

We're just a few weeks away from our 12th Annual Hockey Night with the Houston Aeros on February 27th. The Aeros will be taking on the Texas Stars. The Stars are the minor league affiliate of the Dallas Stars. They occupied 1st place for most of the season but have recently been the fallen Stars dropping to 4th place. That makes this game even more important since the Aeros are in 5th place and only the top four teams in each division make the playoff's. The two teams will meet each other 12 times this season and, so far, the Stars are well on top winning 5 of the first 7 contests. However, the Aeros don't like to lose on Hockey Night!

Our 2nd Annual Hockey Night with the San Antonio Rampage will be held on March 27th when the Rampage will take on the Lake Erie Monsters. A month ago, both teams were occupying the cellars of their respective divisions - since then, both have been on winning streaks and are moving up. Neither team is going to want the other to stop their momentum so this will be a great game.

Now that we are having Hockey Night events in two cities, we have a special prize for one of Houston area board members. Board members will be able to register at our Houston Hockey Night to win game tickets for their family and $200 for travel to our March 27th San Antonio event.

Each year, we invite our community volunteers, employees and friends to join us to watch a fun game. We have lots of door prizes, our collectible cowbells and programs for hockey newcomers. Everyone has a great time watching a fast-paced and really cool game. Click the photos below to see fun from the last few years.

|

|

| 2007 | 2008 |

|

|

| Houston 2009 | San Antonio 2009 |

Mark your calendars for February 27th in Houston and March 27th in San Antonio. Reserve your tickets now by sending an email to HockeyNight@ciaservices.com.

CCUCA Trade Show

This year's Cypress Creek United Civic Associations (CCUCA) seminars and trade show will have a safari theme. This is the 24th year for this great event for Board members and other community volunteers. CCUCA does an excellent job at pulling together experts in homeowners associations to present numerous seminars in a format that runs from early Saturday morning until mid afternoon. There is a continental breakfast and a great lunch where you can mingle with board members from many other communities. This year's event is on Saturday, February 20th. Click here to see the seminar schedule.

C.I.A. Services has always been an active participant in this trade show by having a great booth and presenting seminars. You can view some of our prior seminars online by visiting the Library page of our web site or clicking the links below.

For more information about CCUCA and the trade show, visit www.ccuca.org.

Upcoming Seminars

Our C.I.A. Services Seminar Series is back after a break for the holidays. This is our 7th year of presenting educational seminars for our board members and other community volunteers. Each seminar concentrates on the practical aspects of the topic and provides board members with background knowledge to help them in their decision making. We consistently receive positive feedback on the content and presentation. To view the seminar descriptions and full schedule, click here or visit the Library page of our website.

Each seminar begins at 6:00 p.m. and runs 2 hours. We provide deli sandwiches so you won't have to rush to eat dinner beforehand. You'll leave with knowledge you can use immediately and a great notebook with the seminar slides, samples and reference materials for your future reference and to share with others.

Understanding Collections & Financial Reports

The first half of this seminar will cover all the steps involved in successful assessment collections. Since not everyone pays on time, we'll get into late fees, liens, payment plans, bankruptcy and all the legal remedies. The second half of the seminar deals with reading and understanding your financial reports. We'll trace the flow of money throughout the reports so you'll never be in the dark when staring at all those numbers.

|

|

Practical Deed Restriction Management

Deed restriction management is one of the most difficult tasks handled by homeowners associations because it involves subjective decisions, homeowner's property and emotions. This seminar covers the steps in deed restriction management and how a process can contain "intelligence" and common sense. We discuss the relation between deed restrictions and architectural guidelines and give you examples of well crafted guidelines. Practical deed restriction management requires clear communications and reasonable requirements.

|

You can register at any time by calling 713-981-9000 or emailing seminars@ciaservices.com.

Community of the Month

We are proud of every one of our communities so it is always hard to find just one to highlight. We start by having each of our Community Managers write a nomination for one of their communities. We then read them and take a vote. Here are our most recent selections:

- February - Stable Gate Homeowners Association

Southwest Office - Kim Easterling, Community Manager - January - Fairway Pointe Community Association

Southwest Office - Libby Hodges, Community Manager - December - Kings Lake Forest Homeowners Association

North Office - Annette Escarenio, Community Manager

To see the full story on these communities and to see the past winners, visit the Community of the Month page on our web site.

Anniversaries

Every month we appreciate the communities that are celebrating their anniversaries with us. Here are the clients that started with us in February.

- Oyster Point Homeowners Association — 14 years

- Oak Hollow Homeowners Association — 9 years

- Eastpoint Subdivision Homeowners Association — 7 years

- Silverglen North Homeowners Association — 7 years

- Post Wood Civic Association — 6 years

- Greensbrook Community Association — 4 years

- Whispering Lakes Homeowners Association — 2 years

Our goal has always been to create a positive, long term relationship with all of our client communities. We are very proud to be managing all of these communities.

Employee Spotlight

- Congratulations to Shelly Brady, an administrative assistant and stockholder at our North Office, on her 12 year anniversary with C.I.A. Services.

- Welcome to Felicia Dungy who has joined our Southwest Office to provide staff support in all areas.

|

|

|

| Shelly Brady | Felicia Dungy |

| C.I.A. Services, Inc. www.ciaservices.com Toll Free: 866-219-0563 |

||

| Southwest Office 9800 Centre Parkway, Suite 625 Houston, Texas 77036-8294 Phone: 713-981-9000 Fax: 713-981-9090 |

North Office 8811 FM 1960 Bypass, Suite 200 Humble, Texas 77338-4023 Phone: 281-852-1700 Fax: 281-852-4861 |

Bandera Office 465 Bear Springs Road Pipe Creek, Texas 78063-3178 Phone: 830-535-6222 Fax: 830-535-4265 |

(c) 2010 C.I.A. Services, Inc.